Bank of England hikes interest rates to 5.25 per cent - what this means for your mortgage

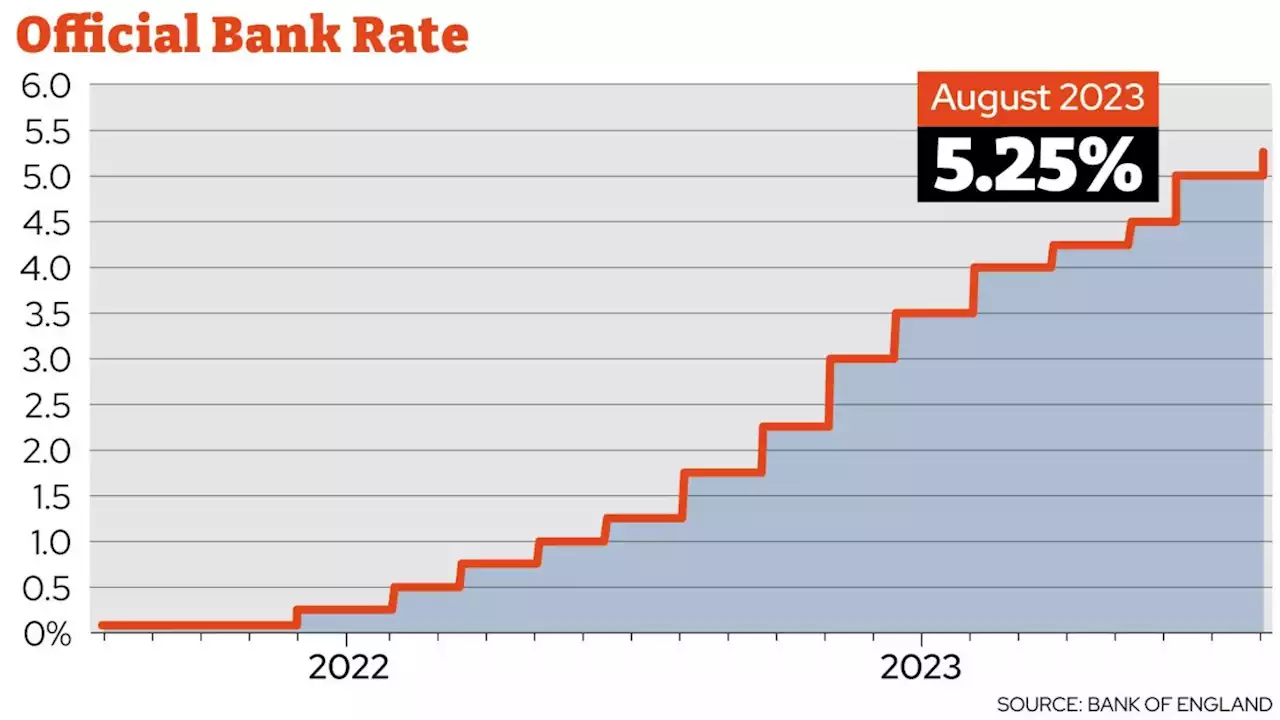

Interest rates have now reached yet another record-high following the Bank of England's Monetary Policy Committee meeting today . After a majority vote of 6-3, the base rate has now been raised to 5.25 per cent - up from 5 per cent in June - which is now the highest level seen since March 2008.

TotallyMoney has broken down the potential rises mortgage holders could face following the latest interest rate increase, with the average UK homeowner on a variable rate needing to fork out an additional £32 per month, with repayments up by £593 in total since November 2021. "There are an estimated 2 million homeowners on variable rate deals, such as Base Rate trackers or even their lender’s SVR , who will see an almost immediate rise in their monthly repayments following the latest Base Rate rise.

"For example, to demonstrate the range between lender’s SVRs: Newcastle Building society's SVR is only 5.94% whereas Virgin Money's SVR is 8.74%. "The past few weeks have seen the rising mortgage payments and high-interest rates make front page news, with these increases pressuring the finances of millions of borrowers in Britain, triggering a surge of uncertainty about where interest rates will go next," they said.

Belgique Dernières Nouvelles, Belgique Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Bank of England expected to hike interest rate for 14th time in a rowEconomists think a 0.25 percentage point rise to 5.25% is the most likely outcome on Thursday. But there are concerns about the impact of rising rates on many households.

Bank of England expected to hike interest rate for 14th time in a rowEconomists think a 0.25 percentage point rise to 5.25% is the most likely outcome on Thursday. But there are concerns about the impact of rising rates on many households.

Lire la suite »

Bank of England increases interest rate for 14th time in a row to 5.25%BREAKING: The Bank of England has increased the base interest rate from 5% to 5.25% in the 14th consecutive hike 📺 Sky 501, Virgin 602, Freeview 233 and YouTube

Bank of England increases interest rate for 14th time in a row to 5.25%BREAKING: The Bank of England has increased the base interest rate from 5% to 5.25% in the 14th consecutive hike 📺 Sky 501, Virgin 602, Freeview 233 and YouTube

Lire la suite »

Bank of England increases interest rates to 5.25% - what it means for mortgages and savingsThe Bank of England has increased the base rate from 5% to 5.25% this lunchtime, the 14th consecutive rise since December 2021, when rates were just 0.1% Here, CallumCMason examines what a 0.25 percentage point rise means for your money ⬇️

Bank of England increases interest rates to 5.25% - what it means for mortgages and savingsThe Bank of England has increased the base rate from 5% to 5.25% this lunchtime, the 14th consecutive rise since December 2021, when rates were just 0.1% Here, CallumCMason examines what a 0.25 percentage point rise means for your money ⬇️

Lire la suite »

Mortgage warning for millions as Bank of England hikes interest rates againMILLIONS of homeowners are braced for more mortgage misery as the Bank of England has hiked interest rates to a new 15-year high. The Bank’s Monetary Policy Committee (MPC) has lifted the…

Mortgage warning for millions as Bank of England hikes interest rates againMILLIONS of homeowners are braced for more mortgage misery as the Bank of England has hiked interest rates to a new 15-year high. The Bank’s Monetary Policy Committee (MPC) has lifted the…

Lire la suite »

Bank of England interest rates LIVE as base rate hiked to 5.25 per centThe Bank of England’s Monetary Policy Committee is announcing its decision on whether to raise rates today

Bank of England interest rates LIVE as base rate hiked to 5.25 per centThe Bank of England’s Monetary Policy Committee is announcing its decision on whether to raise rates today

Lire la suite »

Sarah Breeden appointed deputy Bank of England governor\n\t\t\tGet local insights from Lisbon to Moscow with an unrivalled network of journalists across Europe,\n\t\t\texpert analysis, our dedicated ‘Brussels Briefing’ newsletter. Customise your myFT page to track\n\t\t\tthe countries of your choice.\n\t\t

Lire la suite »